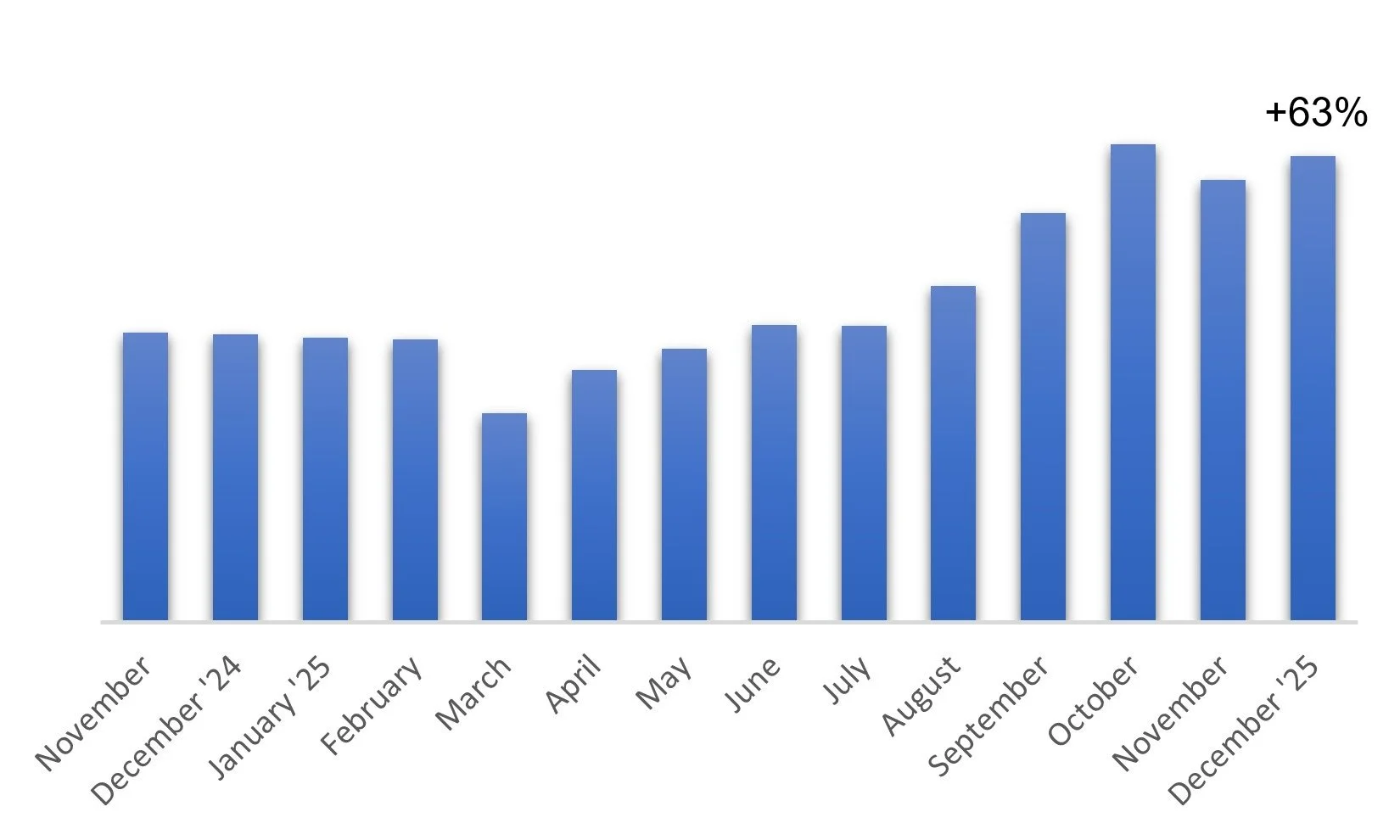

On December 31, 2025, my portoflio has gained 63% for the year, I have zero debt, and no taxes owed for 2024. 2025 taxes have not yet been deducted.

The graph shows my base (the cash I have for investment) after all living expenses and is updated at month end. It reflects the deduction of advance rent set aside, typically 12 months, as well as any credit card debt. These deductions provide a more accurate representation of my true base after all living expenses. It does not, however, include capital gains tax I may owe, which will be deducted at the end of each year or whenever possible. My goals are to consistently grow this figure on an annual basis, maintain zero or near-zero debt, improve the consistency of my investing/trading habits and execution, and take full advantage of compounding over time.

This Weekly Update: December 26

Executed trades this week: None.

If no trades, time since last trade order: 4 weeks.

News this week: $GLSI about doubled this past month up to and after the open-label trial report at the end of last week. Shorts may be covering. Funds may be increasing exposure or initiating. They also reported on Monday additional details of their corporate, financing, partnering strategies, and trial plans. What stood out to me is diligence in managing funds and their ATM which means they are unlikely to do a large raise. And I liked they are highlighting the potential for partnerships. It looks like they are planning further patent filings specifically around non‑HLA‑A*02 use of GLSI‑100 to lengthen IP life. and feel that will strengthen partnership positioning. And they mention this could come at any time before or after interim analysis. Holding this one. It is going to rocket some time in 2026, and I am likely just going to have wished I’d owned more.

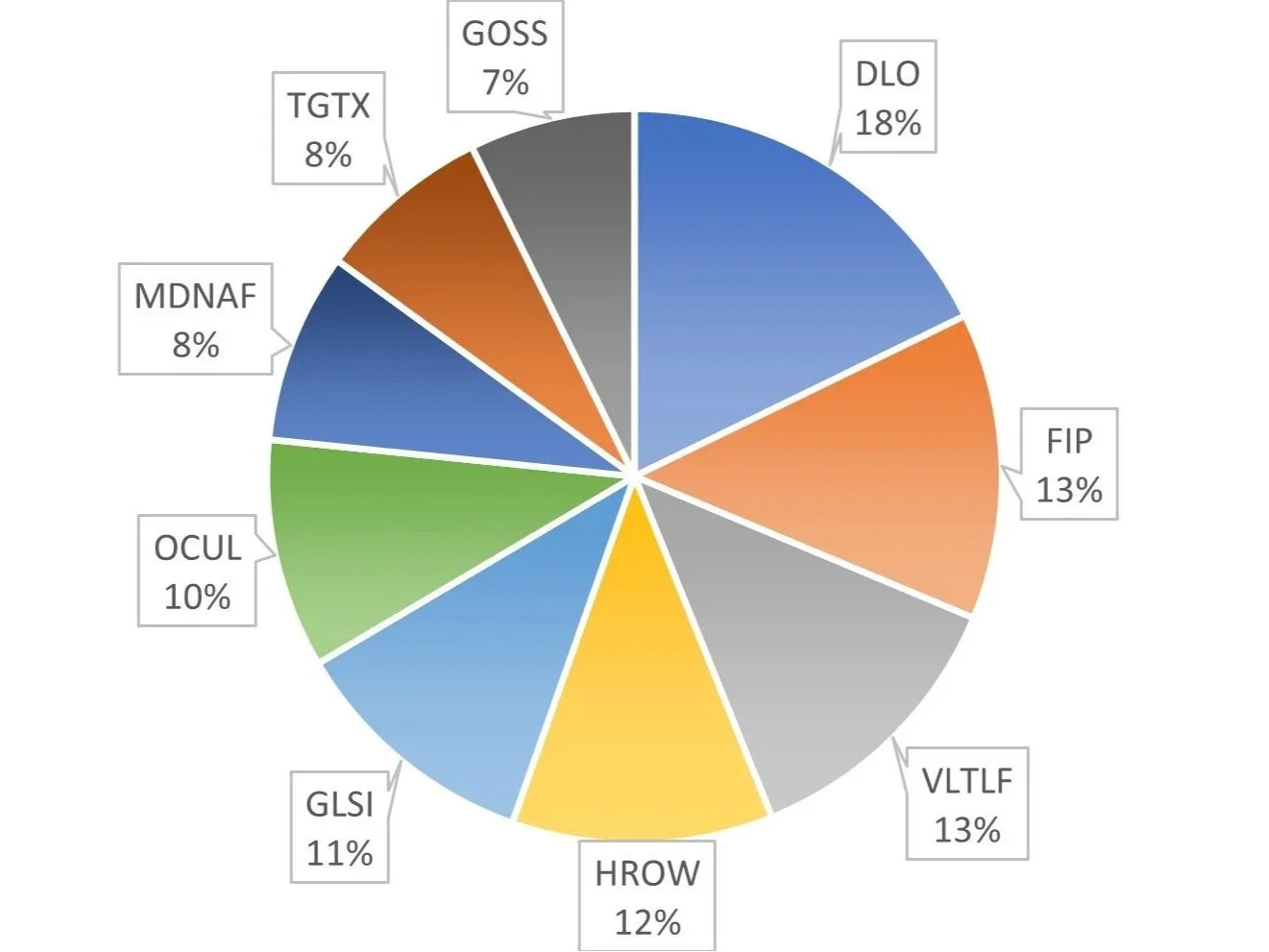

Number of holdings: 9

Unrealized Gains/Losses today: DLO -0.76%; FIP -2.92%; VLTLF +310.67%; HROW +42.05%; GLSI +81.67%; OCUL +2.1%; MDNAF -31.25%; TGTX +0.33%; GOSS +20.20%

Next Update: January 2, 2026

On mobile devices the best view of the table below is likely horizontal orientation.

| Ticker | Company | Reason I'm Buying |

|---|---|---|

| DLO | DLocal Ltd. | Long-term holder and have traded DLO twice this year profitably. DLocal is the undisputed in cross border payments, particularly in emerging markets. They're growing and have a long runway. TPV is popping, revenue is growing rapidly, EPS continues to rise. The take rate is declining as expected and profit margins with it. While typical for this type of company, the market doesn't know yet how to value DLO given these dynamics. I think if the EPS continues to rise and FCF as well (though unlikely in sync short-term) over the long-term as I expect, this will continue to be very attractive. DLocal is one of the lowest risk investments in the market, in my opinion. Solid management executing flawlessly and consistently. Integrations and major partnerships are announced on a rolling basis.

12/27/25: I am simply looking to see continued execution by this company and CEO as described here. The Q4 report and guidance for 2026 at the end of February should continue to tell the same story. |

| HROW | Harrow Inc. | New position, looking to be a long-term holder. Harrow is undervalued as an upcoming fastest growing ophthalmology company. They have the infrastructure, leadership, and execution to warrant a higher quarter over quarter growth rate than the market gives them credit for right now. A growth rate that should last for the next 6-8 quarters and beyond.

12/27/25: Script data look strong in Q4 and while Q1 is seasonally the slowest, this is also when payors kick in for the first time for Harrow. Next year should be great for the Company and stock price. I am looking to see continued execution. |

| VLTLF | LiberyStream Infrastructure | Long-term holder. Previously Volt Lithium, LibertyStream is able to extract lithium from oil field brine, a waste product of oil drilling. This provides the opportunity for a second stream of income for oil companies and water treatment companies focused on extracting valuable resources from oilfield brine like LiberyStream's partner Wellspring Hydro. It also serves as a domestic supply of lithium for the US. The company has just recently completed the purchase of a small $2.5M chemistry set to convert their lithium chloride eluate to lithium carbonate, the finished product for the end user's requirements. We are waiting on JV announcement most likely with an oil company. The nearest competitor to VLTLF will require $1.5B and some years to construct their prototype whereas VLTLF is able to get going for just $20M and scale. JV announcement could be imminent.

12/27/25: Recent non-brokered private placement gives runway for producing samples of lithium carbonate to send potential customers for testing. Offtake agreements to follow. Waiting now. In the meantime, commodity prices for LC are rising. |

| MDNAF | Medicenna Therapeutics Inc. | Long-term holder and have traded profitably once before. Medicenna is in Phase 1/2 for their engineered IL2 in multiple cancer types both as a monotherapy and in combination with Keytruda. Some background knokwledge of the IL2 space is important to understand here. Pharma poured many $billions into IL2 because of the promise of stimulating the body's own natural immune response to fight cancer but toxicity levels were always too high. It has taken many years for the IL2 space to reemerge thanks to engineered versions, like MDNA11. MDNA11 selectively activates the "gas pedal" of the immune system (CD8+/NK cells) while removing the "brake" (Tregs) and the "danger" (Vascular Leak). It is still early but monotherapy results have been excellent and recent combination data with Keytruda - which would work with MDNA11 by then showing the immune system which cells are the cancer cells - shows promise. I believe this is an excellent candidate for large pharma to acquire. Recent deals and acquisitions in the space are in the $1-2B range and so far MDNA11 is proving it is the best in class. There are other drugs in the pipeline, but this is the one to watch.

12/27/25: The stock price will be flat or down without more developments but I am keeping attention on the data. Funds need to step in and provide funding to advance the Company or the eventual buy-out or deal with Merck I'm looking for would need to happen. Anything is possible now. Funds will run out mid-2026 and I'm not expecting more significant data on MDNA11 until at least mid-2026. |

| FIP | FTAI Infrastructure | Reinitiated position at a lower price. Have sold FIP once for a loss and once for a gain this year. My conviction has changed now as the company continues to execute and is reaching several inflection points including the potential sale of Long Ridge possibly after or in conjunction with announcing more power off-take agreements, the construction of the Rapuano Storage Caverns, the integration their most recent acquisition which closed in August of the Wheeling & Lake Erie Railway Company basically doubling their rail business and financing options. |

| OCUL | Ocular Therapeutix Inc. | First trade recently initiated. Ocular is about to announce Phase 3 results in wet AMD. This is widely expected to be successful in the biotech investor community, and I believe the market will soon be forced to rerate and factor in the massive TAM and peak sales estimates between 3-5B. We could see a 100% move or more on this data and expectations for approval. The market is beginning to factor in and will start to give more value to the rest of their pipeline after late-stage trials begin for those (soon). Interestingly, the C-suite is also incentivized to get the stock over $30/sh. On 12/5/25, the Company filed an 8-K stating they will be filing in 2025 after the first Phase 3 is completed instead of waiting until the second Phase 3 completion in 2026 per new FDA protocols. Good news! |

| TGTX | TG Therapeutics, Inc. | Second trade for me. First was profitable, around 30% gain. The stock has since fallen near where I'd previously bought it at 27+, now 30+/share. Briumvi is FDA approved for adults with relapsing forms of multiple sclerosis (MS), including clinically isolated syndrome (CIS), relapsing-remitting MS (RRMS), and active secondary progressive MS (SPMS). The relapse rate is something like once every 90 years. The sales growth has been steady and is expected to continue. Once patients are on Briumvi, they stay on so what is almost the equivalent of recurring revenue and profits here are massive in time. By 2030, likely looking at close to $2.5B annual sales. Current trials are for a modified dose regimen for easier administration in-clinic and a subcutaneous at-home administration trial, the latter of which is the most market expanding opportunity and data will be available on that sometime in 2027. The Company is profitable and there is little chance of further dilution. |

| GOSS | Gossamer Bio Inc. | First trade recently initiated. Phase 3 results in PAH expected February 2026. Massive upside potential. This is a catalyst play for me so position size adjusted down for that. Assuming it succeeds, I'll be looking to load more shares then. |

| GLSI | Greenwich LifeSciences | Long-term holder. Greenwich is in registrational Phase 3 for preventing breast cancer recurrence. Huge success in previous trial. 14 "events" needed to trigger the first interim analysis. Estimates from different AI tools put this somewhere between second half 2026 and second half 2027. I don't want to miss it. This could be a 1,000% gainer from here on positive results. CEO share purchases are consistent and high. A lot of skin in the game. On 12/5/2025, the Company announced they have enrolled 1,000 patients in either of the two HLA groups and will continue enrollment. There are multiple reasons why they cited. The adaptive protocol amendment, guided by the Steering Committee and emerging data on GP2 efficacy across HLA types, allows ongoing enrollment to generate more events for multiple interim analyses, refine cohort sizes, and support broader labeling claims (e.g., all HER2+ patients) while leveraging high screening rates (~150/quarter). This enhances regulatory flexibility and commercial potential without altering the primary endpoint power. The does not increase the time to interim analysis for which 14 "events" is required. An event here is defined as invasive breast cancer recurrence. |